The stock market often seems to be a strange space where people

make fortunes and then lose it all. The often strange-sounding terminology

can put off many from investing in it, even when

it is actually quite easy to invest and make safe returns.

Investment is generally considered to be a good way to

make a passive income that you don't need to work to earn.

It is also important to understand that were cash actually drops in

value over time due to inflation (think about how a million dollars would

buy far more a hundred years ago than it would now), stocks,

if handled correctly, will appreciate in value over time.

DISCLAIMER: PLEASE REMEMBER THAT I AM NOT A PROFESSIONAL IN THESE

MATTERS. DO NOT FOLLOW MY ADVICE WITHOUT DOING YOUR OWN

RESEARCH! I AM NOT RESPONSIBLE FOR ANY GAINS OR LOSSES YOU MAY MAKE!

make fortunes and then lose it all. The often strange-sounding terminology

can put off many from investing in it, even when

it is actually quite easy to invest and make safe returns.

Investment is generally considered to be a good way to

make a passive income that you don't need to work to earn.

It is also important to understand that were cash actually drops in

value over time due to inflation (think about how a million dollars would

buy far more a hundred years ago than it would now), stocks,

if handled correctly, will appreciate in value over time.

DISCLAIMER: PLEASE REMEMBER THAT I AM NOT A PROFESSIONAL IN THESE

MATTERS. DO NOT FOLLOW MY ADVICE WITHOUT DOING YOUR OWN

RESEARCH! I AM NOT RESPONSIBLE FOR ANY GAINS OR LOSSES YOU MAY MAKE!

1. Why should you invest?

Investing, if done correctly, can be an easy way to make a decent income on

the side. It is a practice which allows you to make money with money, and it

has become easier and easier to do so. We have been in what is known as

a "bull" market since 2008, where the market overall just goes up and up.

This is the longest bull market ever, and fears of a bear market (downwards market), have been for the most part quelled. You should take advantage of

this situation to make some money through investing, but there are some

steps you need to take to do so. Read further to find out what these are.

Investing, if done correctly, can be an easy way to make a decent income on

the side. It is a practice which allows you to make money with money, and it

has become easier and easier to do so. We have been in what is known as

a "bull" market since 2008, where the market overall just goes up and up.

This is the longest bull market ever, and fears of a bear market (downwards market), have been for the most part quelled. You should take advantage of

this situation to make some money through investing, but there are some

steps you need to take to do so. Read further to find out what these are.

1. Choosing a Broker

The first thing you will need to do is get set up with a broker, someone who

can complete the deals for you. There are many platforms available,

but what you need you keep in mind is that most platforms charge

a commission for each trade. Some new platforms, like Robinhood,

allow you to trade for free, but at the same time, you will not receive

the advice and analyst ratings you might get from another broker.

Choose your broker based on pricing and who you trust.

Some major brokers are:

can complete the deals for you. There are many platforms available,

but what you need you keep in mind is that most platforms charge

a commission for each trade. Some new platforms, like Robinhood,

allow you to trade for free, but at the same time, you will not receive

the advice and analyst ratings you might get from another broker.

Choose your broker based on pricing and who you trust.

Some major brokers are:

- TD Ameritrade: no account minimums plus some cash they will give

- to start out with

- Fidelity: Reliable, trusted

- Etrade, Charles Schwab, Robinhood and many more

- Look into all of these before making a decision.

Investing often seems confusing, with lots of different terms. It is really

much simpler than it sounds.

- Stock Symbols: The abbreviation of a company name that is used to identify it in the market. Usually less than 4 letters.

- Examples: AAPL (Apple), AMZN (Amazon)

- Buying Power: The amount of money you are able to spend. This is generally just your cash, but some brokers will let you loan money from them, which would be added to your buying power.

- Share: What you buy when purchasing a stock. It is a small stake in ownership of the company. As an "owner" you are entitled to have a shareholder vote in company decisions.

- Analyst: Someone who makes predictions on where a stock will go, usually professionally. An analyst recommendation often changes the stock price, so make sure you listen!

- Price target: The value that an analyst believes a share will reach. They will change their targets, so keep an eye out.

- P/E Ratio: A measure of a stock calculated by taking the value of one share and dividing it by their earnings per share. Generally, a high P/E ratio (higher value, lower earnings) represents that there is a lot of expected growth (or decline). A low P/E ratio (lower value, higher earnings) means that the stock has settled and is a reliable, safe investment.

- Dividend: Some stocks will pay out a certain amount of money to you, the investor, regardless of how they are doing. If you need a steady income coming from your investments, this is often the way to go.

- Funds: Large investment pools which you put money into, and then an investment firm, like BlackRock, and you will get your returns.

- Bull/Bear market: A bull market consistently goes up. Our current bull market just became the longest and strongest ever, rising for the last 10 years since 2008. Several companies shares have tripled or quadrupled in this market. Bear markets are the opposite, and consistently go down.

- Options: A much riskier way of investing. DO NOT DO THIS UNLESS YOU ARE AN EXPERIENCED INVESTOR! I will go over this at the end of the blog.

3. Making your first trade

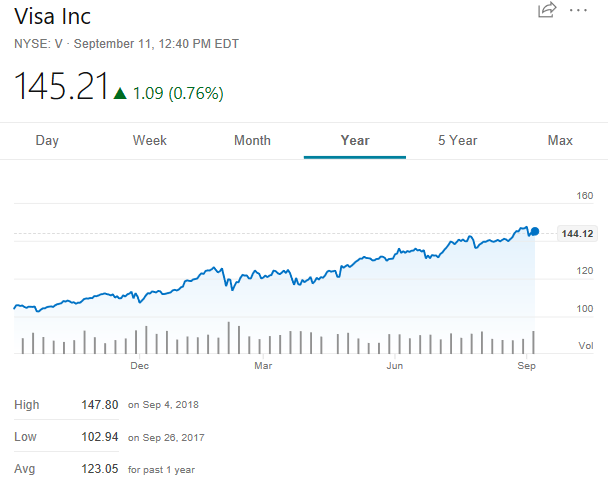

There are many things to know when making your first trade. Read analyst ratings, be aware of the economic news, and make sure you understand how that company is doing. Look at their share price over a year, two years. Is it stable enough for you? Below I will show two graphs of companies' share prices.

The above is a picture of Tesla Motors Inc's stock price over 1 year. It swings wildly between highs and lows, often entirely dependent on public perception of their CEO, Elon Musk. This is not a good stock to invest in, as returns are unlikely and unsafe.

The above are pictures of Visa and Amazon's stock price. They steadily grow across the year, growing 50% in Visa's case and over 100% in Amazon's case. They are steady stocks to invest in that will most likely give you an excellent return.

4. What to do if your shares suddenly rocket or tank

Recently, I found myself in this situation. I have invested some money into AMD, a graphics card and computer processor company. Over the last 2 months, AMD became the number one performing stock this year, with over 190% gains this year, going from $9 in January to its current price around $30. I had to ask myself several questions, which apply not only when a stock goes up, but when it goes down too.

- Is this deserved?

- When a stock goes up, you have to consider if this is just random inflation, or if the stock really did deserve to go up.

- If the answer is yes, you may consider selling now and buying a correction (brief dip)

- Alternatively, yo may just want to hold.

- If the answer is no, you may just want to sell.

- What do analysts think?

- Did they alter their price targets to reflect this?

- Don't get too concerned.

- Unless you have picked a volatile stock, odds are that the stock will recover. Recently AMZN dropped from $2000 to $1950. Although it seems like a large drop, in the larger scheme of things, it will continue to go up. A good rule of thumb is to generally let your investments ride, and don't watch them too much. It'll only stress you unnecessarily.

5. Selling your shares

Although it is important not to be shaken by volatility, you also need to be prepared to sell. Don't always hold on for more profits, especially if you don't see a future for the company. Most times, companies recover from setbacks, but if you feel they have been overvalued or peaked, or if you feel that the volatility of it is becoming an issue, sell. Any profit is a good profit, and cutting your losses is often necessary.

Something important to remember when investing is this: never invest money you can't afford to lose. The stock market, if done right, can give you steady, good returns. But you can't bank on that. Only invest what you can, and never any more.

Something important to remember when investing is this: never invest money you can't afford to lose. The stock market, if done right, can give you steady, good returns. But you can't bank on that. Only invest what you can, and never any more.

6. Options

WARNING: ONLY CONTINUE IF YOU ARE WILLLING TO DO SIGNIFICANT RESEARCH!

This is a field that requires far more in depth study to understand

fully, and I don't recommend investing in it until you completely understand it. Options are, more or less, bets that a stock will go

up or down. The gains you can make are multiplied tenfold, but the losses are too. There are ways to make it safer and mitigate potential losses, but these require an in depth understanding which simply

can't be fit into a single blog post. I will, however,

go over the basics.

This is a field that requires far more in depth study to understand

fully, and I don't recommend investing in it until you completely understand it. Options are, more or less, bets that a stock will go

up or down. The gains you can make are multiplied tenfold, but the losses are too. There are ways to make it safer and mitigate potential losses, but these require an in depth understanding which simply

can't be fit into a single blog post. I will, however,

go over the basics.

- The basics

- Puts

- A bet that the stock will go down. How it works is that you pay a certain premium for a contract which says you will sell a stock at a certain price.

- Example:

- Let's say you purchase a contract expiring in 2 months with a strike price (sell price) of $30 for a premium of $1 a share. Options always come in bundles of 100 shares so you will pay $100.

- The stock price is currently at $40. If the price drops to $25 before the expiration, you could either sell the contract itself at a profit (because the terms are more lucrative now, selling higher than market value), or you can execute the contract, purchasing 100 shares for $25 a share, and then selling them for $30 a share.

- You make $5 a share, and subtracting your premium you have a profit of $400.

- Calls

- A bet that the stock will go up. You purchase a contract promising to buy a 100 shares at a set price per share, generally higher than current value, by a certain expiration date.

- Example:

- You purchase a call that expires in 2 months with a strike price of $40. The share is currently worth $30.

- Prior to expiration, it hits $50. You can either sell the contract for a profit, or execute, buying the shares for $40 each and selling for $50 each, with a profit of $10 a share, or $1000.

- Subtract the contract price for your final profit.

There are some risks to be aware of. If the expiration date on the contract passes, it expires worthless and you lose all the money you paid for the contract. Your contract will also change greatly in value even as the stock changes a tiny amount, as it is all of a sudden less or more likely it will hit your strike price. Your contract also depreciates in value over time, as there is less time for the price to rise or fall to your strike price.

Those are the very basics of options. There is more to them, but you should not consider them until you have a firm base in investing, and have done research of your own.

6. Final things to remember

- The most important thing to remember is that you should not allow your investing to get in the way of your everyday life. Although it can provide a significant source of income, if you do not manage your time right it could simply end up being a drain on you.

- The second thing to remember is to always keep some buying power in your account. If a stock drops, and you use your buying power to buy in at the dip, your overall average purchase price is lowered so that your losses are not quite as stark.

- Finally, DO YOUR OWN RESEARCH! Don't just trust or follow blindly what anyone, professional or otherwise, says. Your own assessment of a company can often be superior, as these analysts have to focus on the whole market, not just that one stock.

I hope this blog helped uncover more about investing to you, and prepared you to invest in the future!

Image credits in the order they appear:

https://cdn.moneysmart.id/wp-content/uploads/2017/03/netloid_16-us-ipos-to-look-out-for-this-week-april-7-april-12.jpg

http://christophergamboa.com/wp-content/uploads/2014/02/Definition.png

https://www.google.com/search?rlz=1C1CHBF_enUS807US807&ei=rJehW-2_D-GX0wLVs6GgBQ&q=tsla+stock&oq=tsla+stock&gs_l=psy-ab.3..35i39j0i20i263j0i131j0l2j0i10j0l4.15413.15791..15943...0.0..0.80.287.4......0....1..gws-wiz.......0i71j0i7i30j0i131i67j0i131i20i263.PPWIBLlW54I

https://www.google.com/search?rlz=1C1CHBF_enUS807US807&ei=ypehW6m_DoaU0gKOiIL4Aw&q=amzn+stock&oq=amzn+stock&gs_l=psy-ab.3..0i71l8.0.0..6067...0.0..0.0.0.......0......gws-wiz.g8mB7taLgr0

https://www.google.com/search?q=v+stock&rlz=1C1CHBF_enUS807US807&oq=v+stock&aqs=chrome..69i57j0l2j69i60l2j0.871j0j7&sourceid=chrome&ie=UTF-8

https://www.fool.com.au/wp-content/uploads/2017/04/Rocket-Launch-Space-16.9.jpg

https://www.lombardiletter.com/wp-content/uploads/2017/01/QCOM-Stock.jpg

http://www.adigitalblogger.com/wp-content/uploads/BEST-DEMAT-ACCOUNT-1-compressed-10.jpg

Kabir very well done. I totally enjoyed my time reading your blog I think you did an excellent job explaining how the stock market works on a simple level. I don't know if you had to perform some research yourself to write it or maybe you are an expert on the subject but I think it was very well explained, easy to read and understand. I believe your intended audience is people who don'y know much about the stock market and are trying to learn more how it works. I think your blog is very appealing for anyone not only people interested in the stock market, myself is an example for it; before reading your blog I had no clue about the stock market and how it works but now after reading it I have a very good idea of how it works. Got to say that after reading your blog I became more interested on the subject and now I'm feeling like selling my car or laptop to be able to buy some shares lol... JK!!!!!!!!!!!! :P HAHAHAH :)

ReplyDeleteGreat job!!!! again on your blog totally liked it.